Lower the Estate Tax Exemption to Wipe Out the US National Debt

The U.S. national debt is often treated as an unsolvable problem—too large, too abstract, too politically toxic to touch. At nearly forty trillion dollars, the number feels disconnected from everyday reality.

But the debt only looks impossible in isolation.

When you place it next to where American wealth actually resides, a very different picture appears. Not a simple solution—but a real one, with real tradeoffs.

The Scale of the Problem (and the Wealth)

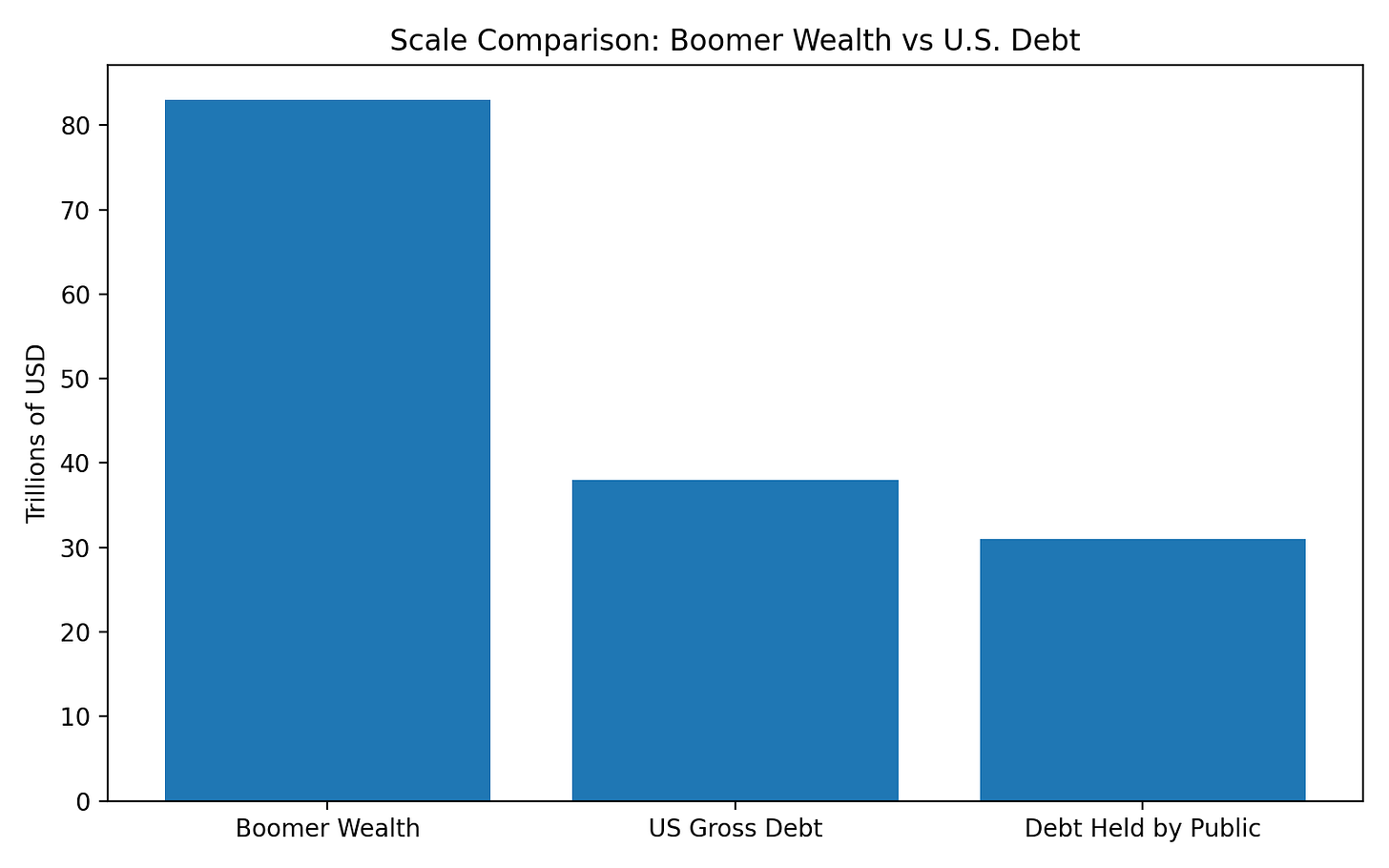

As of late 2025, total U.S. federal debt stands at roughly $38 trillion. Of that amount, about $31 trillion is debt held by the public—Treasury securities owned by investors, institutions, and foreign governments. This is the portion economists usually focus on, because it represents external obligations.

Now compare that with Baby Boomer wealth.

Americans born between 1946 and 1964 collectively hold about $83 trillion in net wealth—more than half of all U.S. household wealth.

This comparison changes the framing. The United States is not “broke.” The money exists. It is simply concentrated and lightly taxed at the point of transfer.

Average vs. Median: Why This Matters

Wealth among Boomers is highly uneven:

Average (mean) net worth: roughly $1.2–$1.7 million

Median net worth: roughly $200,000–$400,000

This distinction matters because estate taxes apply only to the top of the distribution. Most Americans—and most Boomers—are nowhere near today’s exemption thresholds.

How the Estate Tax Works Today

Top federal estate tax rate: 40%

Estate tax exemption: ~$14–15 million per individual

Share of estates that pay: fewer than 0.2%

Despite an unprecedented intergenerational wealth transfer already underway, the estate tax raises relatively little revenue.

A Simple Thought Experiment

To understand scale—not to propose a literal policy—consider a simplified model:

Assumptions (for illustration only):

Total Boomer wealth: ~$83T

Estate tax rate: 40%

Wealth above an exemption is taxed once, over time

Ignore avoidance, deductions, timing, and behavior

This is not how policy works. It is a measuring tool.

Could Boomer Wealth Retire the National Debt?

Total gross debt (~$38T):

Even taxing all Boomer wealth at 40% raises only ~$33T → not enough.Debt held by the public (~$31T):

Mathematically achievable at a 40% rate with a very low exemption.

The math shows capacity. But math alone is not policy.

The Overlooked Question: Would This Be Deflationary?

Yes—by default, retiring all or most of the national debt would be deflationary.

This is where many “just pay it off” arguments quietly collapse.

Paying down federal debt removes financial assets from the private sector. Treasury securities are not just liabilities—they are core infrastructure of the financial system.

How Fast Matters More Than Whether

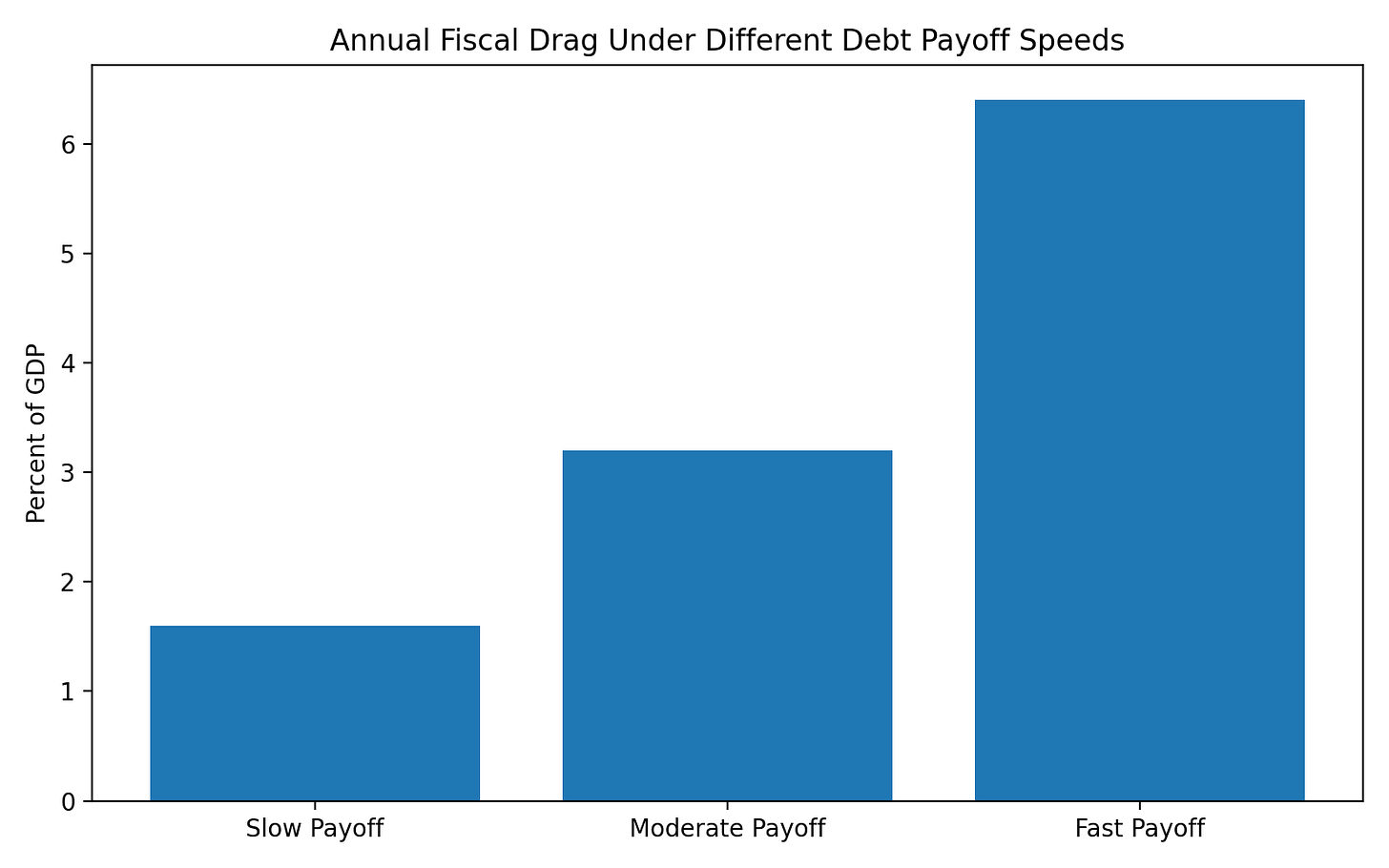

The economic risk depends almost entirely on speed.

What this chart shows:

A slow payoff (~0.5T/year) creates manageable drag

A moderate payoff (~1T/year) is meaningfully contractionary

A fast payoff (~2T/year) risks recession and financial stress

Three Payoff Paths

1. Fast Payoff (High Risk)

Aggressive estate taxation and rapid debt retirement.

Likely outcome:

Strong deflationary pressure, tighter credit, recession risk.

2. Phased Payoff With Offsets

Gradual debt reduction over decades, paired with:

Public investment

Tax cuts elsewhere

Monetary accommodation

Likely outcome:

Debt declines without choking demand.

3. Partial Payoff (Most Stable Option)

Reduce debt relative to GDP, not to zero, while preserving a deep Treasury market.

Likely outcome:

Lower long-term fiscal risk without destabilizing the system.

The Deeper Insight

The national debt is not like household debt.

From a macroeconomic perspective, it represents the net financial assets of the private sector. Eliminating it entirely would mean fewer safe assets, tighter credit, and less financial flexibility.

The goal should not be zero debt, but the right amount of debt, sensibly balanced against private inherited wealth.

Final Thought

Over the coming decades, Baby Boomers will pass on more than $80 trillion in wealth.

We will choose:

To fund the future through inheritance, or

To fund it through debt

Lowering the estate tax exemption would not magically solve everything. But it would force an honest reckoning with how wealth, risk, and responsibility are shared across generations.

The debt exists.

The wealth exists.

What remains is deciding which one we want to pass on.